The Federal Reserve's interest rate decisions have a significant impact on both businesses and families. Global central banks use interest rates as a tool to expand the money supply during an expansionary phase and decrease it during a recessionary phase in order to assist economies. At its most recent meeting in March 2024, the FOMC (Federal Open Market Committee) decided to maintain the same range of interest rates, 5.25% to 5.50%. The Committee believes that this tightening cycle, which started in early 2022, has peaked at the policy rate. The FOMC is adamant about getting inflation back to its target of 2 percent.

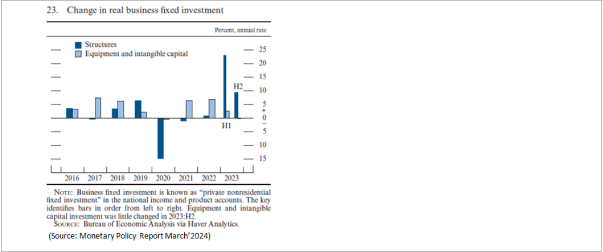

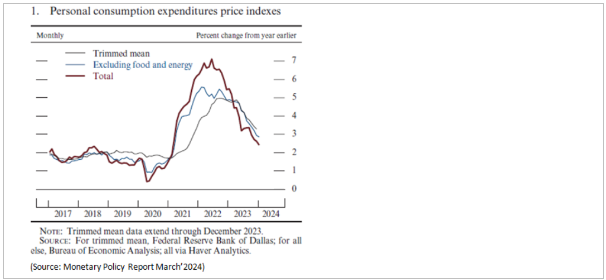

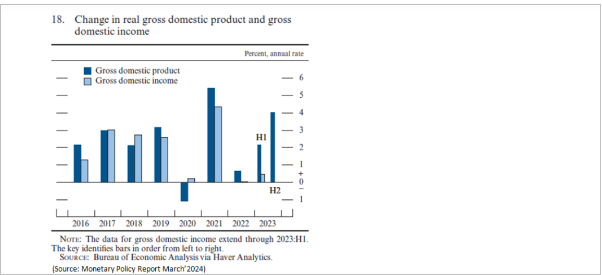

Although inflation is still higher than the FOMC's target of 2%, it has significantly decreased in the last 12 months. Inflation significantly decreased in 2021 and 2022 before picking up again in 2023. While down from a peak of 7.1 percent in 2022, the price index for personal consumption expenditures (PCE) increased by 2.4 percent over the course of the 12 months ending in January. This is still more than the FOMC's longer-run target of 2 percent. The job market is still tight, with a historically low unemployment rate and a high number of open positions. Strong improvements in consumer expenditure have also contributed to the real GDP's strong expansion. According to reports, the real gross domestic product (GDP) increased from 2.2 percent in the first half to 4.0 percent in the second half of 2023. Overall GDP growth in 2023 was 3.1%, which was significantly faster than in 2022 even with tight financial conditions, such as high longer-term interest rates. Consumer spending increased steadily, and after a downturn since early 2021, the housing market activity began to pick back up in the second half of 2023. After accounting for inflation, consumer expenditure increased steadily in 2023, rising 3.0 percent in the second half and 2.7 percent overall. Strong job market conditions and growing real earnings helped consumers remain resilient in the face of challenging financial circumstances. But the growth in real business fixed investment decreased, probably as a result of tighter financial conditions and downbeat business sentiments.

Since June 2023, bank lending to individuals and companies has significantly decreased as a result of tighter lending criteria and a decline in loan demand. Asset valuations are being driven higher by tighter financial conditions, as evidenced by real estate prices that are higher than rentals and high price-to-earnings ratios in equity markets. Over the past year, consumer financing requirements have become more stringent. The majority of consumers can still get credit, despite the fact that interest rates on credit cards and vehicle loans are still higher than they were in 2018, during the height of the previous round of tighter monetary policy. The general demand for housing has decreased and the housing sector's activity has slowed significantly due to the increase in mortgage interest rates since early 2022. The mortgage rate shift was exceptionally significant .

The 30-year fixed rate increased from approximately 3.2 percent in January 2022 to nearly 8 percent in October 2023, the highest level since 2000. This was an exceptionally big and quick shift in mortgage rates. Mortgage rates averaged over 7% in February 2024, despite a little decrease since October. Furthermore, in the second half of 2023, company investments have slowed due to tighter financial conditions and negative business sentiments. The nation saw a decrease in equipment spending in the second half of 2023, while R&D and software investments slowed from their strong growth rate in the preceding several years. Throughout the second half of 2023, investments in semiconductors and electric vehicle batteries in nonresidential structures also decreased. Despite recent improvements in indices of company sentiment and profit forecasts, sentiment is still muted.