Today, hydrogen is gaining remarkable traction. The world shouldn't pass up this exceptional opportunity to include hydrogen heavily in our secure and sustainable energy future.

Energy and hydrogen have a long history together; they both powered the earliest internal combustion engines more than 200 years ago, and hydrogen is now a crucial component of the refining industry of today. It emits no greenhouse gases or pollutants directly, is lightweight, storable, and has a high energy density. However, hydrogen must be embraced in industries like transportation, construction, and power generation where it is presently essentially nonexistent if it is to have a major impact on the shift to sustainable energy.

In-depth, unbiased analysis of hydrogen is provided in The Future of Hydrogen, which outlines current conditions, how hydrogen may contribute to a secure, cheap, and clean energy future, and how to fully realise its promise.

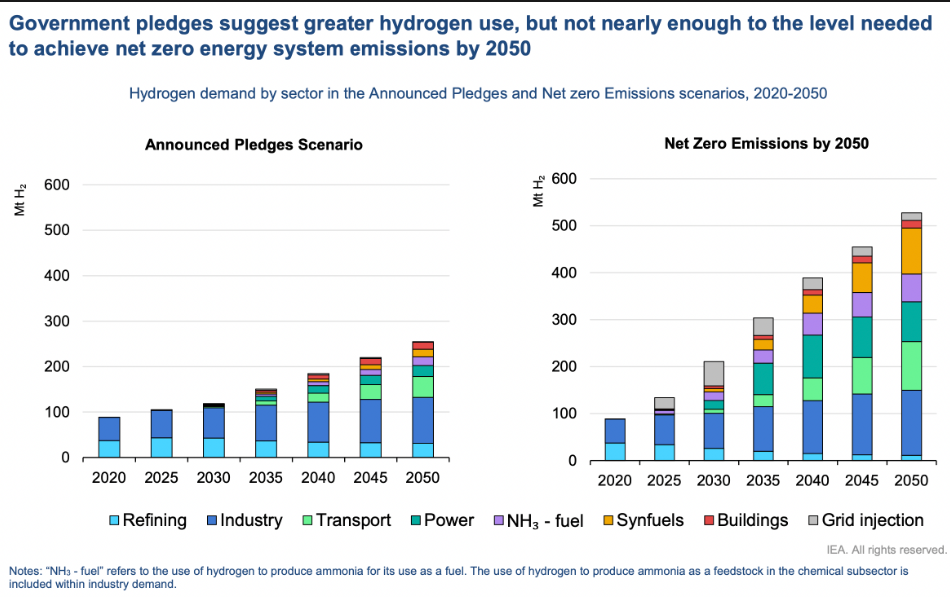

Demand for hydrogen

Source: iea.org

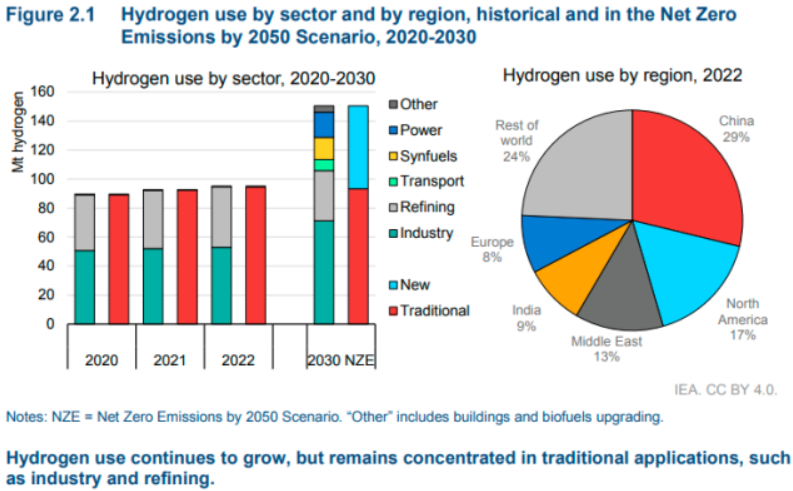

Today, it is a significant global industry to supply hydrogen to industrial users. With 6% of the world's natural gas and 2% of its coal going towards hydrogen generation, the demand for hydrogen, which has more than tripled since 1975, is still growing. Hydrogen is virtually exclusively provided by fossil fuels.

For this reason, the annual carbon dioxide emissions caused by the generation of hydrogen are around 830 million tonnes, which is the same as the combined emissions of the United Kingdom and Indonesia.

Expanding backing

Both the number of nations with policies that specifically encourage investment in hydrogen technologies and the sectors they focus on are rising.

Currently, there are about fifty targets, mandates, and policy incentives that directly support hydrogen, most of which are transportation-related.

Although it has increased recently, national governments have been spending more globally on hydrogen energy research, development, and demonstration, even if it is still less than it was at its highest point in 2008.

Source: clean50.com

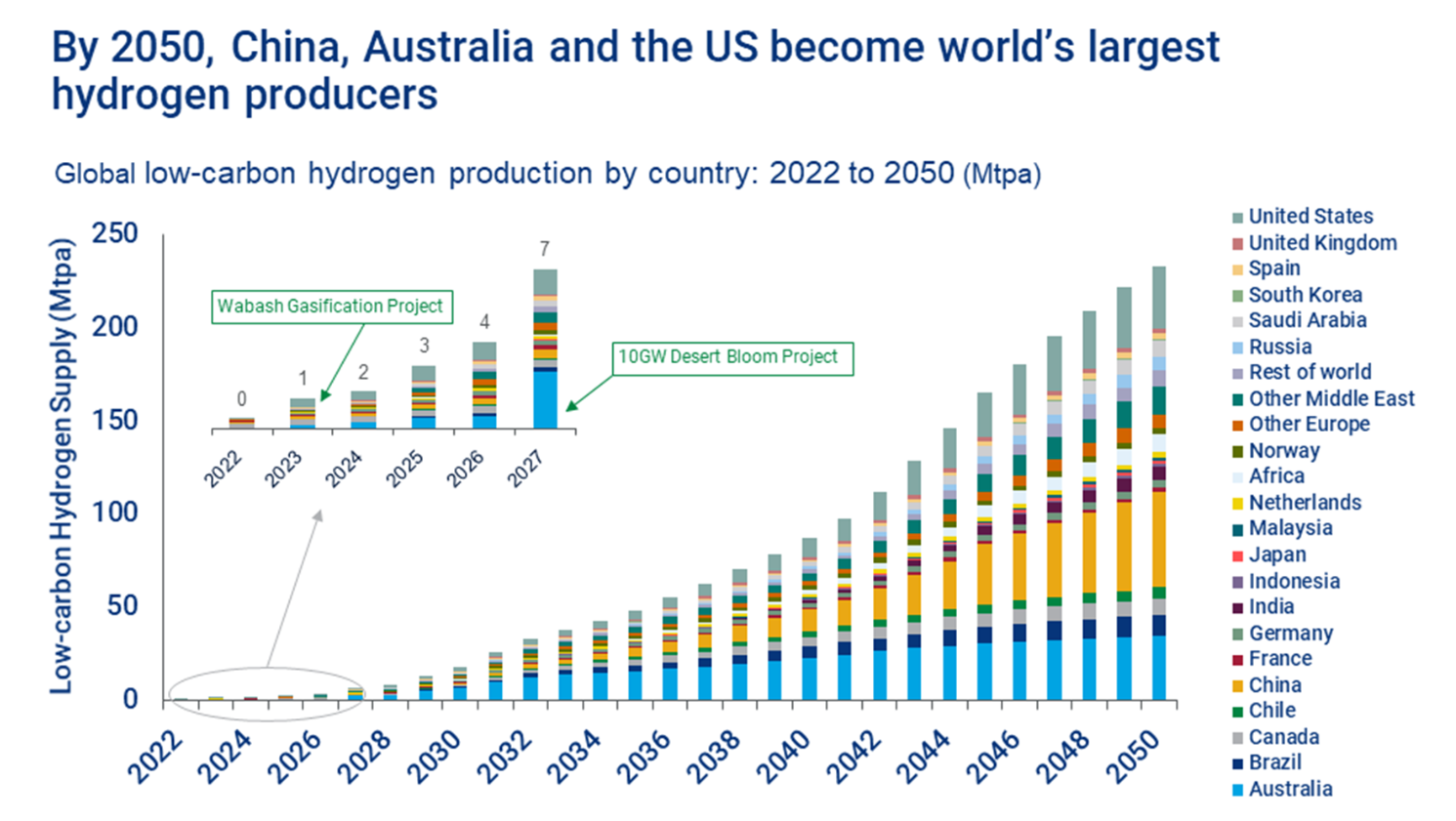

Production of Hydrogen

Source: Woodmac.com

It is possible to extract hydrogen from water, biomass, fossil fuels, or a combination of the three. Currently, natural gas is the main source used to produce hydrogen, making up about 75 million tonnes of the yearly dedicated hydrogen produced globally. This makes around 6% of the natural gas used worldwide. Due of coal's prominence in China, gas comes in second, with a tiny amount coming from the use of electricity and oil.

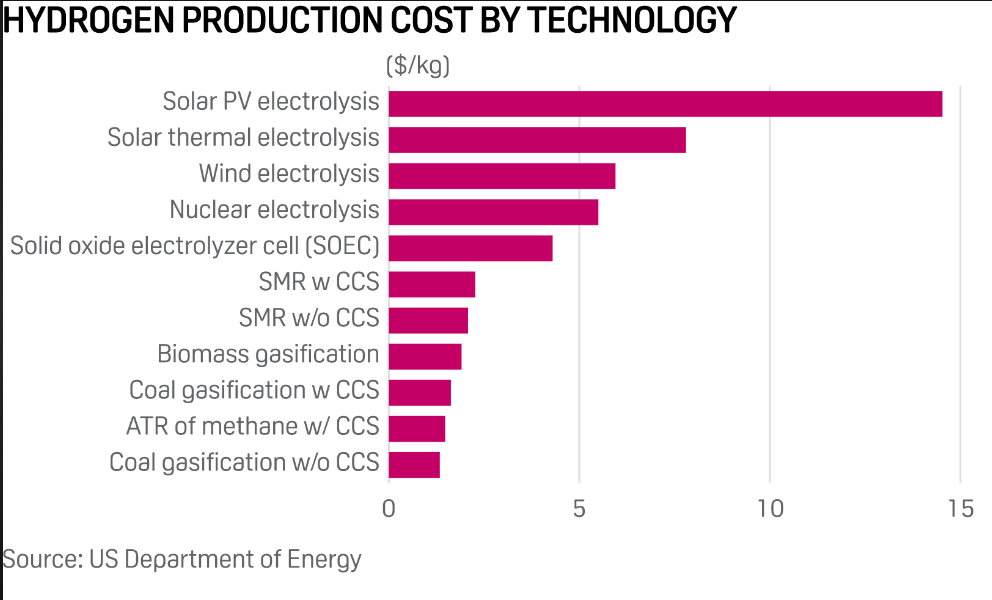

A number of technological and economic factors affect the cost of producing hydrogen from natural gas; the two most significant ones are capital expenses and gas pricing.

Fuel prices comprise between 45% and 75% of production costs, making them the greatest cost component. Some of the lowest expenses for producing hydrogen are found in the Middle East, Russia, and North America due to their cheap petrol prices. greater petrol import prices mean greater expenses for producing hydrogen for petrol importers like Japan, Korea, China, and India.

Although water electrolysis currently accounts for less than 0.1% of the world's devoted hydrogen production, interest in electrolytic hydrogen is growing as the cost of renewable electricity, particularly from solar PV and wind, is on the decline.

Monitoring expenses

Dedicated nuclear or renewable energy production of electricity provides an alternative to using grid electricity for hydrogen production.

There have been a number of demonstration projects using electrolytic hydrogen in recent years, and interest in the technology is growing due to the falling costs of renewable electricity, especially from solar PV and wind. The electricity required to produce all of the dedicated hydrogen production produced now would be 3,600 TWh, which is more than the European Union produces in a year.

Even after accounting for the transmission and distribution costs of transporting hydrogen from (often remote) renewable locations to the end-users, building electrolysers at locations with excellent conditions for renewable resources could become a low-cost supply option for hydrogen due to the declining costs associated with solar PV and wind generation.

Hydrogen has several applications.

Source: greentechlead.com

Today, industry—specifically, the manufacturing of steel, ammonia, methanol, and oil—dominates the usage of hydrogen. Since fossil fuels are used to supply almost all of this hydrogen, clean hydrogen has a large potential to reduce emissions.

While trucks prioritise lowering the delivered price of hydrogen, hydrogen fuel cell automobiles' competitiveness in the transportation market is dependent on fuel cell costs and refuelling facilities. Hydrogen-based fuels offer an opportunity because low-carbon fuel sources for shipping and aviation are limited.

With the greatest potential in multifamily and commercial buildings, especially in densely populated areas, hydrogen might be blended with the natural gas networks already in place in buildings. Longer-term prospects could involve the direct use of hydrogen in hydrogen fuel cells or boilers.

Hydrogen may be combined with the natural gas networks that are now installed in buildings, having the most potential in multifamily and commercial buildings, particularly in neighbourhoods with high population densities. Longer-term possibilities might include using hydrogen directly in boilers or hydrogen fuel cells.

Short-term, realistic chances to implement policy

Although it has not yet reached its full potential to assist the transition to clean energy, hydrogen is currently widely used in some industries. To further remove obstacles and cut expenses, immediate, focused, and ambitious action is required.

The International Energy Agency (IEA) has recognised four value chains that present potential avenues for increasing the supply and consumption of hydrogen by leveraging current sectors, regulations, and infrastructure. Which of them, given their particular geographic, industrial, and energy system contexts, offer the most immediate promise will be able to be determined by governments and other relevant parties.

The entire policy package consisting of the five action areas mentioned above will be required regardless of whether of these four important opportunities—or other value chains not mentioned here—are explored. Additionally, governments will gain from international collaboration with others striving to advance comparable hydrogen markets, whether at the regional, national, or local level.

The seven main suggestions made by the IEA to increase hydrogen

Assign a function to hydrogen in long-term energy plans. Governments at the local, state, and federal levels can influence future expectations. Companies ought to have well-defined long-term objectives. Buildings, chemicals, iron and steel, long-distance and freight transportation, electricity generation, and storage are important industries.

Encourage the market for clean hydrogen. Although there are clean hydrogen technologies available, their costs are still high. Suppliers, distributors, and users must be able to support their investments with policies that create sustainable markets for clean hydrogen, particularly to lower emissions from hydrogen derived from fossil fuels. These investments can result in cost savings from low-carbon electricity or fossil fuels with carbon collection, utilisation, and storage by expanding supply chains.

Take first-movers' investment risks into account. At the riskiest portion of the deployment curve are clean hydrogen supply and infrastructure projects, as well as new applications for hydrogen. The private sector can be assisted in learning, investing, and sharing risks and gains through targeted and time-limited loans, guarantees, and other measures.

Encourage R&D to reduce expenses. R&D is essential to reducing costs and enhancing performance in addition to economies of scale. This includes fuel cells, hydrogen-based fuels, and electrolysers (the device that creates hydrogen from water). Government initiatives are essential for determining the research agenda, taking calculated risks, and luring private resources for innovation. This includes the utilisation of public funding.

Get rid of pointless regulations and unify standards. Regulations and permit requirements that are ambiguous, inappropriate for novel uses, or inconsistent between industries and nations present challenges for project developers. In order to ensure safety, verify emissions from various sources, and ensure equipment, it is imperative to exchange knowledge and harmonise standards. Because of the intricate supply chains for hydrogen, governments, businesses, communities, and civil society must frequently consult.

Participate globally and monitor advancements. All aspects of international cooperation require improvement, but standards, the exchange of best practices, and cross-border infrastructure require special attention. To measure progress towards long-term goals, hydrogen production and consumption need to be regularly monitored and reported.

Over the next ten years, concentrate on four important possibilities to gain even more momentum. These mutually beneficial opportunities can assist to scale up infrastructure development, improve investor confidence, and reduce costs by building on present policies, infrastructure, and skills:

- Utilise current industrial ports to their full potential as hubs for cheaper, greener hydrogen.

- Utilise the current gas infrastructure to promote the production of fresh, clean hydrogen.

- Encourage freight, routes, and transport fleets to increase the competitiveness of fuel-cell cars.

- Create the initial shipping lanes to facilitate the global exchange of hydrogen.