After Bitcoin and other cryptocurrencies made an incredible comeback this year, confidence in the crypto markets is soaring in late December 2023. Because there are so many encouraging triggers in early 2024, investors are expecting what is looking to be a historic year for Bitcoin and cryptocurrencies.

More people than ever are entering the cryptocurrency industry as investors due to the recent spectacular growth in cryptocurrencies. It's possible that you have already utilised utility tokens like Ethereum (ETH), invested in well-known assets like Bitcoin (BTC), or even obtained security tokens like MS tokens to partially own the Millennium Sapphire! The cryptocurrency industry doesn't seem to be slowing down or halting, so what can we anticipate for the market this year and going forward? This is a sneak peek at some of the major trends that we might observe this year in the world of cryptocurrencies.

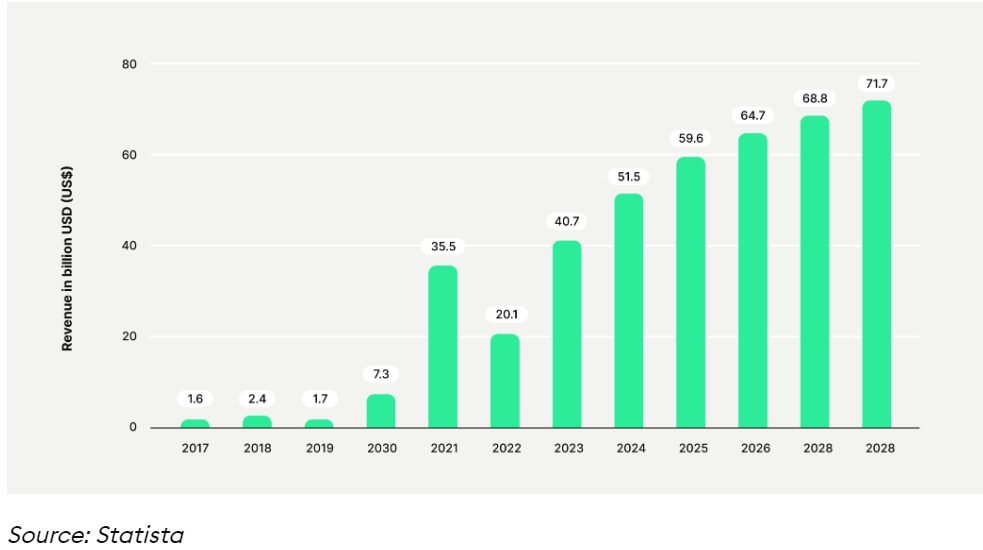

Numerous groups have participated in cryptocurrency transactions in recent years, including skilled traders, internet retailers, digital investors, mobile gamers, and even regular consumers. As a result, it's generally safe to assume that cryptocurrencies will continue to be widely used this year and going forward. According to a new Statista analysis, the global cryptocurrency industry is expected to reach $51.5 billion (USD) in 2024 and $71.7 billion by 2028, with a potential compound annual growth rate (CAGR) of 8.62%.

It's easy to see the promise in the cryptocurrency field, which is why an increasing number of people are entering it. However, it's critical to comprehend, recognise, and steer clear of cybercrime and cryptocurrency scams whether you're an online vendor taking cryptocurrency payments or a digital investor working in the cryptocurrency market.

Prospective patterns in cryptocurrencies that we might see this year:

1. The widespread use of cryptocurrency

The potential of cryptocurrencies to function via decentralised networks outside the boundaries of traditional finance is one of its main draws. Blockchain technology and cryptocurrency have allowed businesses in a variety of sectors, including banking, media, and healthcare, to operate in different ways. Many experts predict that blockchain technology will continue to have a favourable impact on a wide range of businesses, including the financial industry, and that the mainstream will increasingly accept digital currencies. While traditional investors are becoming more receptive to investing in the cryptocurrency market, certain financial institutions have already started to sell and accept digital assets.

Mastercard, a major payment card company, stated in 2021 that it would facilitate several cryptocurrencies directly on its network. Following an increase in customer demand, Citi also explored offering cryptocurrency services. Approximately 90% of central banks worldwide have reportedly announced plans to launch digital currencies. In addition, a great deal of companies are innovating within their specific industries. For example, the financial sector is utilising cryptographic authentication, while e-commerce and retail are developing new payment systems. In the upcoming years, you should anticipate seeing additional advancements in the field of digital currencies across a range of industries.

2. Bitcoin's unstoppable ascent

First cryptocurrency was Bitcoin (BTC). Presently, it is the most widely used cryptocurrency worldwide, having been introduced in 2009. There's no disputing its continuous ascent, as far as I can tell. A progressive and healthy Bitcoin is anticipated this year and in the future, as seen by the creation of the Ordinals protocol, the Bitcoin halving, and the recent legalisation of spot Bitcoin ETFs in the United States.

It will always be possible to make traditional investments in stocks, bonds, or real estate investment trusts (REITs). A few investors might even search for the best CD rates for their savings accounts, while others might take advantage of the account benefits offered by banks. It is becoming more and more difficult for mainstream and institutional investors to overlook Bitcoin investment, however, as it provides an alternate choice with an intriguingly high growth potential. Bitcoin halving events have historically affected the price of Bitcoin, and the approaching 2024 halving may have a big effect on the entire cryptocurrency market. 2024 might be another fantastic year for the first cryptocurrency monarch as acceptance increases, legal clarity arises, and new improvements in Bitcoin are introduced.

3. The emphasis on blockchain compatibility

Blockchain technology uses a collection of linked blocks of data on a digital ledger to create a distributed ledger that is operated by a separate network of computers. Every block consists of a collection of transactions that have been independently confirmed by network validators. Blockchain is renowned for encrypting data and highlighting the greatest security characteristics.

But because blockchain technology is decentralised and cannot function in traditional networks without middlemen, industry concerns about blockchain interoperability have been significant. This is due to the fact that it isn't linked to databases, other data sources, or existing systems. As a result, important industry participants are now concentrating on creating a blockchain ecosystem that is interconnected. Currently, the objective is to make the most of various blockchain systems in order to communicate and trade digital assets, messages, and data more effectively and effortlessly.

4. The CBDCs' implementation

Central banks have prioritised the development of Central Bank Digital Currencies (CBDCs) in recent times. It's crucial to remember that only China has outlawed cryptocurrency exchanges, a move that ultimately prompted the creation of its own CBDC. However, a number of nations might do the same in 2024.

Numerous global financial authorities are looking for direction when it comes to pursuing central bank funds, according to the International Monetary Fund (IMF). It's possible that certain nations may not now require the establishment of a CBDC within their borders. In the event that they must implement this in the near future, many of them have begun investigating this alternative. While decentralisation may be pushed aside by the creation of CBDCs, this might open the door and hasten the global adoption of digital assets. Additionally, it can be viewed as a means of enhancing cryptocurrency transactions by lowering the likelihood of fraud in the market.

5.TradFi and DeFi's confluence

Decentralised finance (DeFi) and traditional finance (TradFi) are currently distinguished from one another. The banking sector is equipped with well-established protocols. Nonetheless, the business is heading towards total digitalization as a result of the growth of online banking and the usage of digital assets.

In the meanwhile, blockchain technology has demonstrated a great deal of promise for boosting user experience (UX), scalability, and security. In terms of digital infrastructure and interoperability, the DeFi industry is still in its infancy.

6. The way the regulatory environment has changed

Since digital currencies are now widely accepted, relevant laws and regulations must be put into place for the sector. Although the laws and regulations may appear to contradict the goal of decentralisation in cryptocurrencies, they may actually strengthen the market. It may even go so far as to encourage wider public adoption and acceptance. In the end, regulations pertaining to transactions, mining, and cryptocurrency exchanges can enhance the overall ecosystem.

Getting ready for cryptocurrency's future

The world is growing more digital, and cryptocurrencies have a bright and hopeful future. From everything we've looked at, it appears that digital assets will only continue to grow and become more integrated into mainstream technology and banking. Advances in Web3, finance, and the global digital transformation seem primed for long-term effect alongside decentralised technology.

Even if there are still certain risks associated with investing in cryptocurrencies, developing frameworks surrounding these virtual currencies can aid consumers in making better judgements. These advancements will help remove obstacles and make it easier for those who are inquisitive about cryptocurrencies to enter the market. Nonetheless, more accessible and clear regulations are important changes to look forward to and take into account.

In 2024, it is probable that governments, banks, corporations, and consumers will begin to utilise cryptocurrencies and blockchain technology more widely. More stability, openness, and accessibility to the developing economic systems supported by cryptocurrencies could be achieved this year.