Source: cca-acc.com

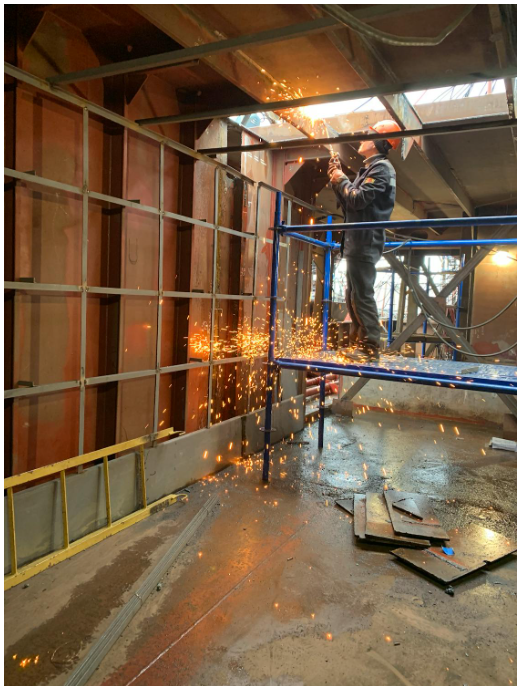

In Canada, the construction industry employs around 1.2 million people, making up 7% of the labour force. It is a significant business. That is a 50% rise in employment over the previous ten years. Due in major part to high immigration, Canada's economy and population are growing, which means there is an increasing demand for housing and infrastructure. This has set up the building sector for rapid expansion in the upcoming years.

The industry is going through a critical period, with new opportunities and challenges that need for organisations to be adaptable. Organisations can position themselves for success by being aware of the challenges ahead and taking the necessary steps to ensure that their procedures are compliant with those of the industry.

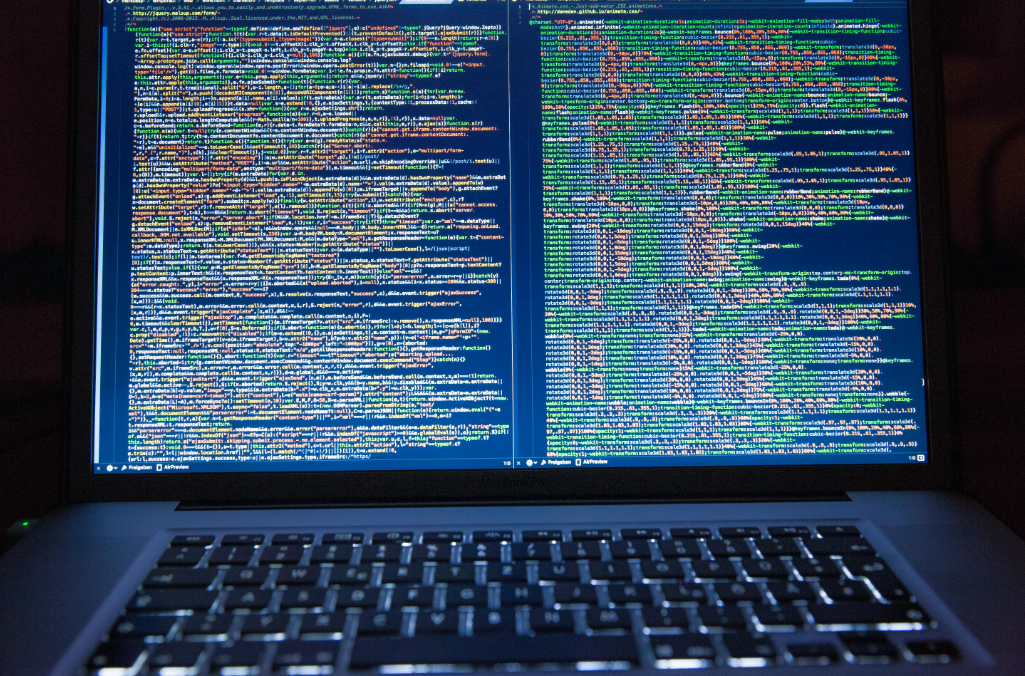

Data availability will increase as risk management becomes more of a focus.

Source: boxofnotes.com

Tens of billions of dollars were lost due to inefficiencies in the construction sector in 2023, with a deficiency in risk management software being the main culprit. More businesses will search for a platform that can link, organise, and extract insights from their construction data in order to lower risks on upcoming projects. The number of Internet of Things (IoT) sensors on machinery and wearables on the jobsite will increase as more businesses use risk management technology. These devices will gather data, which can be linked to the risk management platform.

Building businesses will use artificial intelligence (AI) extensively.

Data and AI will help increase efficiency gains

Project teams typically face a great deal of pressure to finish tasks within a predetermined range of quality and safety standards, on schedule, and within budget. There's additional pressure to record everything, which might take a lot of time. But by 2024, those difficulties will be reduced because to automation in data collection on building sites. AI will help businesses standardise and organise data during the course of a project, especially computer vision and generative AI. AI will simplify data operations in a variety of contexts, including design using building information modelling (BIM), material procurement, and insurance information validation. This is about anticipating obstacles and making necessary course corrections in advance, not merely about accomplishing more with less.

Robotics and augmented reality (AR) will become more commonplace in the building industry.

Although AR was expensive and still in its infancy when it was first introduced, there was little knowledge about how to utilise it. Today, however, people own AR phones and the technology is becoming more widely available. With increasingly sophisticated gear, augmented reality has become more prevalent in the building industry.

For technology to become more widespread, proper setup and precision are essential, and the industry is headed in that direction with dedicated hardware being developed for augmented reality to increase accuracy. In the construction industry, robotics is becoming increasingly prevalent as machines are used to assist with monotonous and late-night duties. And even if there is still a barrier to entry and it is still prohibitively expensive, acceptance will grow with time.

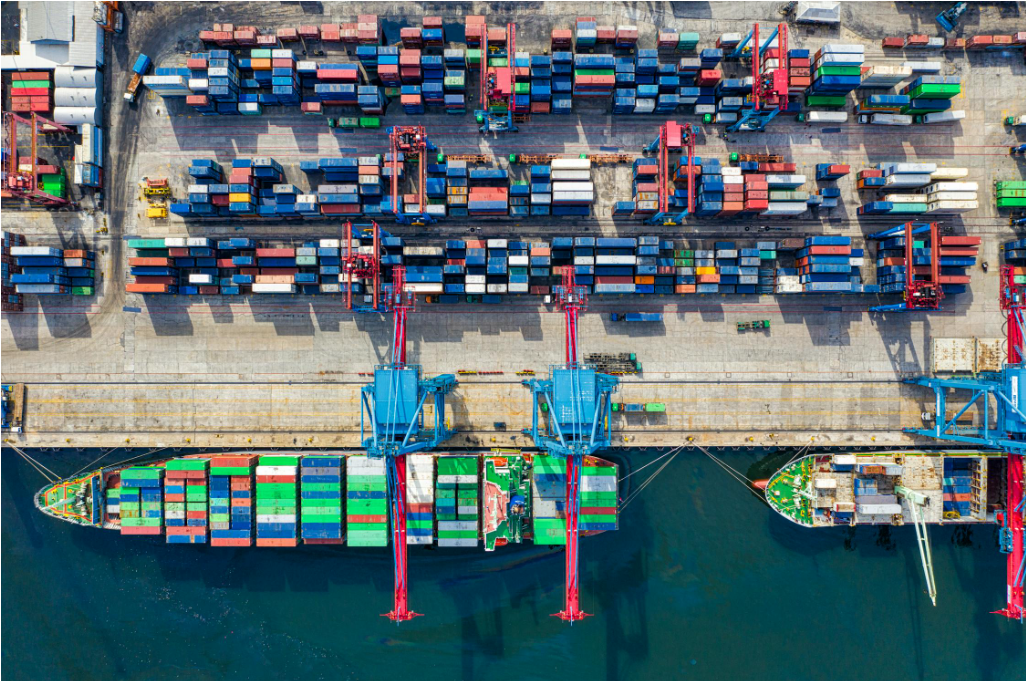

Cost and supply chain concerns may not always disappear, but perhaps not for sustainable materials.

The consequences of the previous few years' supply chain are beginning to lessen, which will lower material costs. The demand for environmentally friendly and sustainable materials, however, may be impacted by the availability and cost of such materials if net-zero buildings become more popular.

Building will monitor the carbon footprint of projects more closely.

It is commonly recognised that the construction sector has a significant carbon footprint, but new technologies are making it easier to identify sources of pollution and raise awareness of the issue, making it easier to assess and control the issue. Canada could take a cue from Europe, which is at the forefront of sustainability in business, since businesses everywhere are beginning to prioritise sustainability.

In the coming years, discussions around mental health in the sector will change.

An increasing number of firms are showcasing their commitment to employee well-being by allocating the necessary funds to establish comprehensive safety initiatives. Talks on mental health will only get bigger, stronger, and more prevalent. In the end, this will result in a complete cultural revolution.

Women and underrepresented groups will be given priority when it comes to hiring and retention.

Building associations are getting better at drawing women and members of underrepresented groups into the industry, but keeping them in has proven to be difficult. The historical lack of flexibility in the construction industry, which frequently conflicts with family responsibilities, is one of the main causes of this retention problem. Future trends indicate that career pathing and staggered shifts for carers will rise, along with innovative ways for businesses to support caring and an increase in part-time employment of returning mothers. Industry will witness more significant collaborations in 2024 and beyond to develop regulations that will let individuals work in a schedule that better fits their personal and professional lives.

The effects of the labour shortfall will remain extensive.

There is a chronic lack of competent labour to fulfil demand, which has very evident effects on the building industry. But in addition to delaying projects and raising safety risks, a labour shortage in the sector causes issues that go beyond construction, driving up costs that impact tenants and buyers of real estate. Additionally, it inhibits the sector from fixing already-aging infrastructure or efficiently future-proofing infrastructure for population expansion and climate change. This implies that increasing the number of people working in construction will be essential for ensuring energy security, house purchasing power, safe commuting, and other benefits in the future. Everyone must seek to recruit as many new employees as possible, not only the industry.

Backlogs in projects will continue until 2024.

In the most current Top Civil and Infrastructure Trends Report published by Procore and the Associated General Contractors of America, Canadian civil and infrastructure contractors stated that their backlogs had grown by 38% from pre-pandemic levels. This growth might be attributed to a number of factors, such as immigration-fueled population growth and strong consumer spending, which hit a record high in the second quarter of last year.

Other drivers that will persist in 2024 are the drive towards green technology, the requirement to create more resilient localised supply chains, and government initiatives.