In brief, in 2023, gold outperformed most stock markets, bonds, and commodities.

According to market opinion, the US will experience a "soft landing" in 2024, which could not be favourable for gold.

In 2024, central bank purchases and geopolitical unrest may provide gold more support.

What is Next?

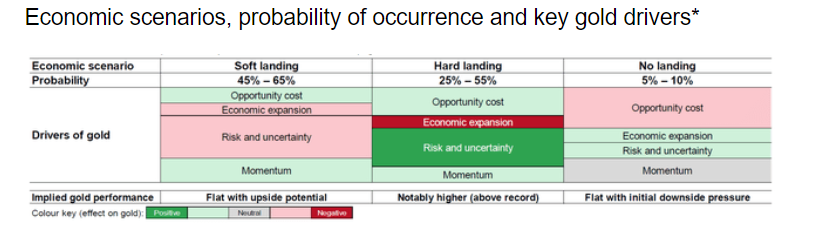

Surpassing forecasts in a climate of rising interest rates, gold outperformed most stock markets, bonds, and commodities in 2023.1. Investors in 2024 are likely to perceive one of three scenarios (Table 1). The market believes that there will be a "soft landing" in the US, which will be good for the world economy as well. Soft landing settings have not historically been very appealing to gold, with returns being flat to slightly negative.

Nevertheless, each cycle is unique. This time, increased geopolitical unrest during a crucial election year for several major economies, along with ongoing central bank purchases, may provide gold further support.

Furthermore, there is no guarantee that the Fed will be able to guide the US economy towards a safe landing with interest rates higher than 5%. Furthermore, a worldwide recession is still likely. This ought to motivate a lot of investors to include gold or other efficient hedges in their portfolios.

Table 1: Three possible outcomes for the world economy in 2024

Source : World Gold Council

Focus is all on the Fed

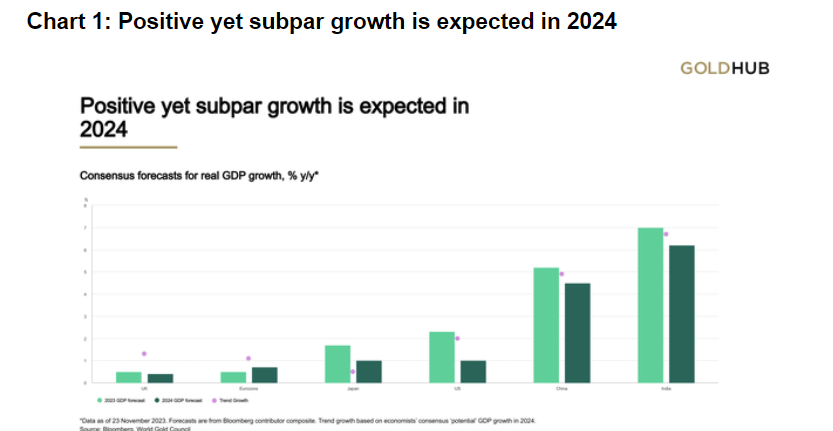

The world economy proved astonishingly durable in 2023, despite some setbacks along the road, and as the year went on, concerns about an oncoming recession waned. Given the assumption of positive, albeit mediocre, growth in the near future, market consensus for 2024 now points to a "soft landing" (Chart 1). Market players anticipate both an economic slowdown and enough cooling of inflation before central banks start lowering interest rates.2. Many investors would be happy to see a smooth landing like this. However, policymakers must execute it with extreme precision and rely on numerous uncontrollable circumstances to come into play.

Sources: World Gold Council, Bloomberg; disclaimer

*As of November 23, 2023. Forecasts come from the contributor composite of Bloomberg. Trend growth determined by the "potential" GDP growth predicted by analysts for 2024.

The composite PMI is still growing, and the manufacturing PMI is greater now than it was in the middle of 2023.3 For the past six months, real profits have increased, which has led to strong balance sheets. The surplus reserves of households have not yet been exhausted5, and the unemployment rate is still very low. Should fiscal stimulus plans for 2024 come to pass, they will provide more assistance.

These elements alone won't stop the economy from slowing down, but when paired with sound monetary policy, they may be able to stop the economy from contracting.

Recessions are still possible in the future.

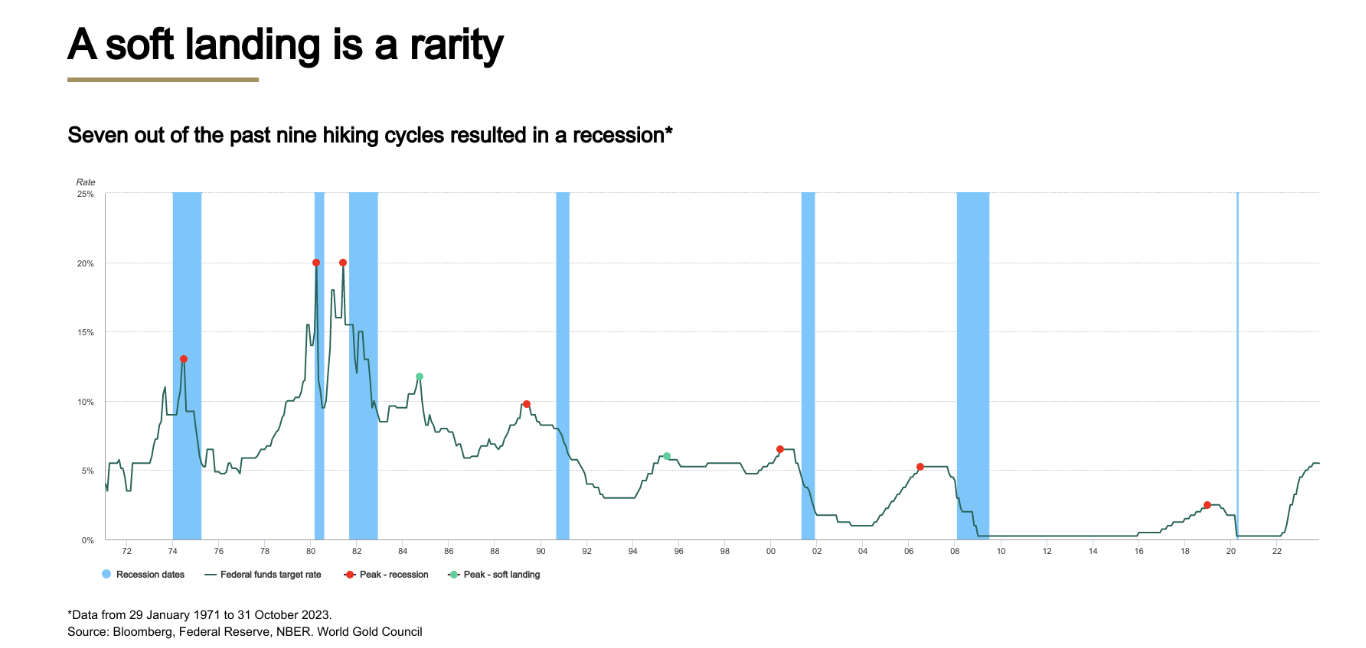

Even while the odds are in favour of the Fed performing a soft landing, this would be a difficult task. In the last fifty years, the Federal Reserve has only twice successfully executed a soft landing after nine tightening cycles. Seven more experienced a recessionary end (Chart 2). This should come as no surprise because pressure on the actual economy and financial markets usually increases when interest rates remain higher for longer periods of time.

Chart 2: Hard landings are uncommon

Recessions have occurred during seven of the last nine hike cycles.

The employment market is a major factor in determining whether the economy will experience a soft landing or a hard landing. Although the US has low unemployment, some of the reasons that supported its resilience in 2023—such as a lack of available labour and strong business balance sheets supported by robust consumer spending—have not only gone but also historically have a tendency to shift very swiftly.

To put things in perspective, prior US recessions typically began five to thirteen months after payroll growth reached the current level.Six Furthermore, the St. Louis Fed's "Sahm rule," a measure of unemployment, suggests that a recession is just a few months away.

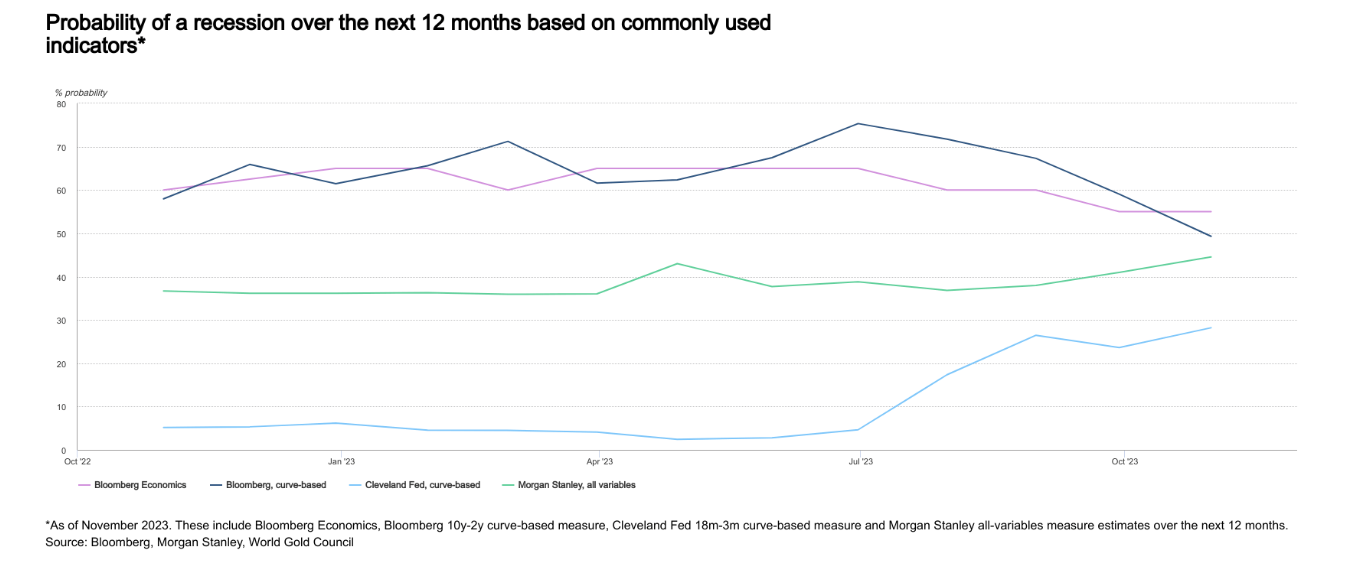

There is still a moderate to large likelihood of a recession, according to a number of widely used indices (Chart 3). These indications point to a 45% chance of a recession during the following 12 months on average.

Chart 3: Predicted rates of recession during the next 12 months, from moderate to major

Investors may not just experience a recession or a soft landing in the upcoming year. Additionally, a "no landing" is anticipated.8In this situation, growth and inflation will pick back up speed. Two possible catalysts for such a situation are the recovery in real wages and the manufacturing sector in the United States.9.

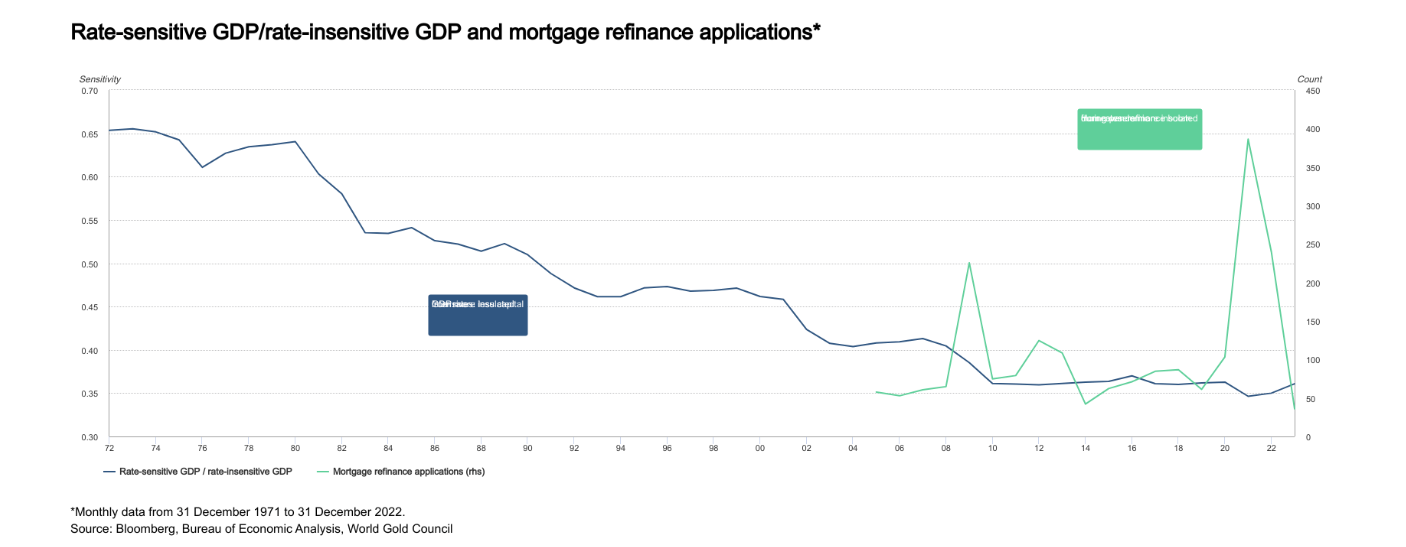

The US economy has become less capital intensive and, hence, less sensitive to interest rates than it was in the past, which is the main argument in favour of this result. Additionally, households have profited from large-scale low-rate pandemic refinancing (Chart 4). 10 Additionally, US corporations have doubled their length during the last 30 years in an attempt to somewhat inoculate themselves against the wave of increasing rates.11

Chart 4: US households and the economy are protected against rate increases

The idea of a return to inflation becomes serious when you factor in the possibility of strikes, the reality that budget cuts are improbable during an election year, and energy price hikes from a potential prolongation of the Israel-Hamas conflict.

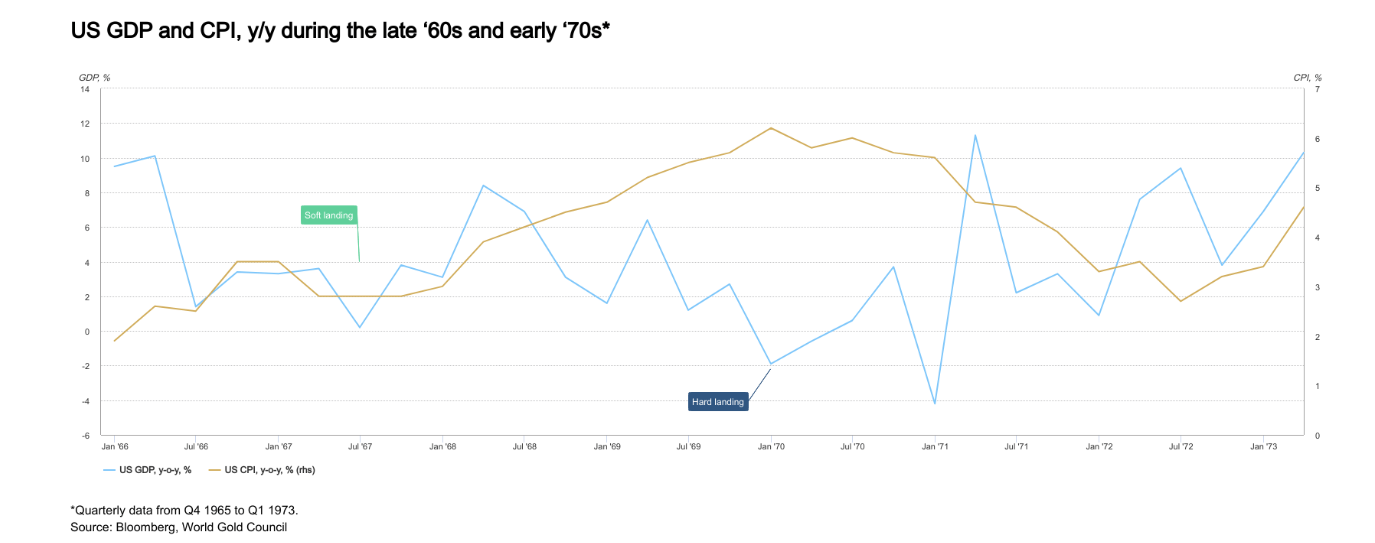

However, we think that a no-landing scenario is an implausible course of events; it's more of an interim condition than an outcome. "A no landing is just a soft or a hard landing waiting to happen," as Morgan Stanley put it.Thirteen Furthermore, a larger recession later on, like it did in the late 1960s, would be more likely if the Fed were forced to hike further, placing additional pressure on individuals and businesses.

Chart 5: Three years after the 1966 soft landing, interest rate hikes caused a hard landing.

Is gold able to separate?

The interplay between gold's functions as an investment asset and a consumer good affects how well it performs. It draws from central bank demand as well as from fabrication and investment flows.14

In order to comprehend its conduct in this setting, we concentrate on four main drivers:15

Growth in the economy is good for consumption

Uncertainty and risk are advantageous for investing

Negative opportunity cost for an investment

Momentum is dependent on positioning and price.

Swerving to make a gentle landing

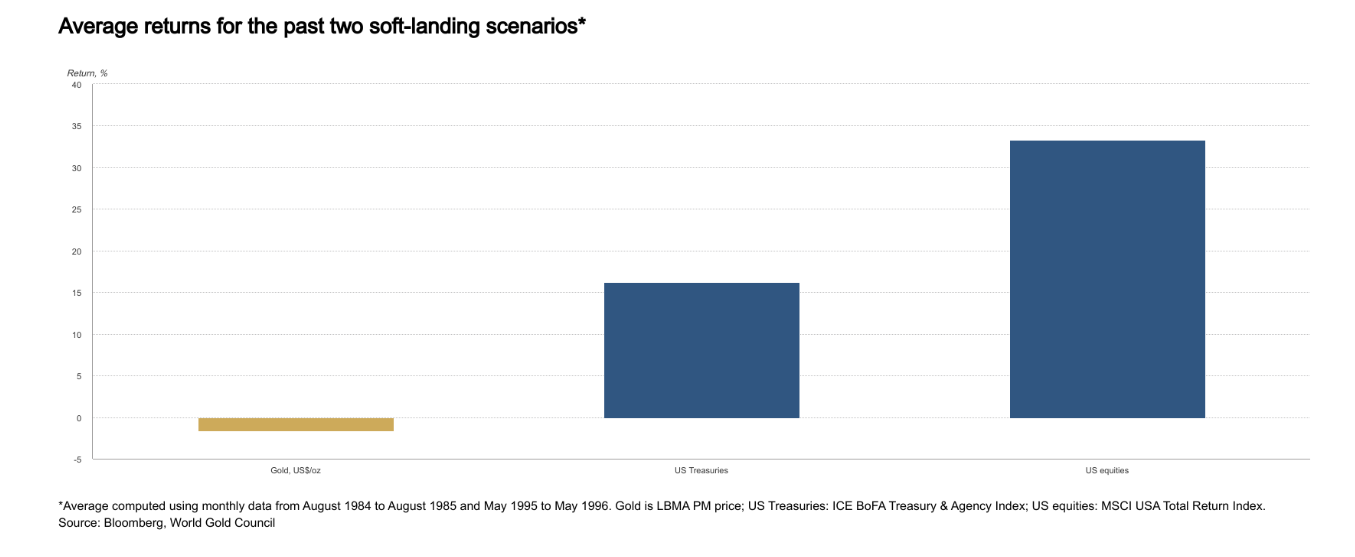

Bonds and riskier assets may benefit from a soft landing. The consensus earnings estimate seems optimistic16, and bonds would continue to be appealing due to high interest rates. Historical data supports this, since during the last two soft landings, stocks and bonds both did well. But gold has not done as well, rising marginally in one and falling in the other.

Chart 6: The last two gentle landings have, on average, left gold's returns flat.

Most likely, two opposing forces are at play here:

reduced nominal rates

decreased inflation.

A break in nominal interest rates should be good for gold: Reductions in policy rates of 75–100bps are probably not going to result in longer-term yield decreases of more than c.40–50bps. We calculate this response taking into account the bull steepening that has happened following previous soft landings, as well as the pressure on term premiums to remain high, the quantitative tightening, and the significant supply of issuance in 2024. If all else is equal, that decline in longer-term yields points to a roughly 4% gain for gold.

Sadly, nothing else is probably equal. Real interest rates will remain high if inflation continues to decline more fast than rates, as is generally predicted. Furthermore, poor growth might limit consumer demand for gold. In conclusion, the outlook for expected policy rate easing for gold may not be as bright as it first seems.

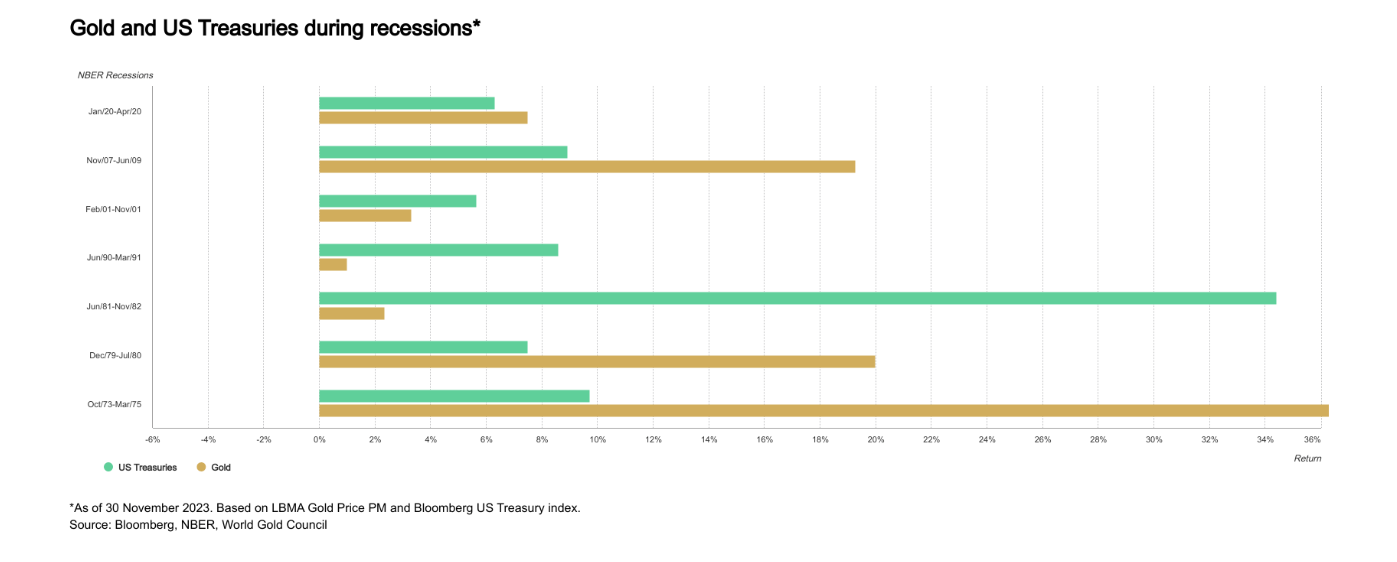

Recessionary out performer with consistent growth

Weaker growth will aid in driving inflation back towards central bank targets if a recession materialises. In response, interest rates would eventually be lowered. Historically, an atmosphere like this has been favourable for gold and premium government bonds.

Chart 7: Historically, gold has done well during recessions

Greater rates could be scary

In the event that the no-landing scenario materialises, gold mining may first prove difficult. Higher rates and a stronger US dollar would probably act as a drag, as they did in September 2023, even though faster economic growth would encourage consumer demand and higher inflation would make hedges more necessary. However, if inflation spiked once again, the government might respond with even more force, which would raise the possibility of a worse (or harsher) landing in the future and make a compelling case for strategic gold allocations.

History might not always be definitive.

According to historical data, the average performance of gold could be flat to somewhat worse in the next year in a soft-landing or no-landing scenario. But there are two more things working in gold's favour this time around:

Many geopolitical hazards exist. The Israel-Hamas conflict and the SVB failure were the two major event threats for 2023. Between 3% and 6% was added to gold's performance by geopolitics. Additionally, investors will probably require more portfolio hedges than usual in a year when there are a number of significant elections occurring around the world, including those in the US, the EU, Taiwan, India, and Taiwan.

Demand from central banks. Throughout the previous two years, gold has defied predictions thanks to purchases made by official institutions. We project that in 2023, surplus central bank demand will have contributed at least 10% to the performance of gold. And they'll probably keep buying.18 We expect that any above-trend buying (i.e., more than 450–500t) should provide a further lift, even if 2024 does not reach the same highs as the previous two years.

Moreover, the likelihood of a recession is not negligible. This would strongly reinforce the argument for keeping a strategic allocation to gold in the portfolio from the standpoint of risk management.