Two conflicts in as many days have impacted the lithium business as nations take positions to restrict supply.

All of a sudden, it appears that the industry is going through major shifts that will soon cause end users, especially the manufacturers, to increase the production of electric vehicles due to growing supply issues.

Yet, Australia might benefit. Already a major supplier of lithium, with numerous additional projects in the works, this nation may soon be regarded as one of the few remaining sources free from geopolitical and political meddling.

The events of last week could also be viewed as just one more cog in the de-globalization wheel, as rival blocs start to fight for supremacy in the economy, particularly China versus the US and the growing challenges to the US dollar's status as the world's reserve currency

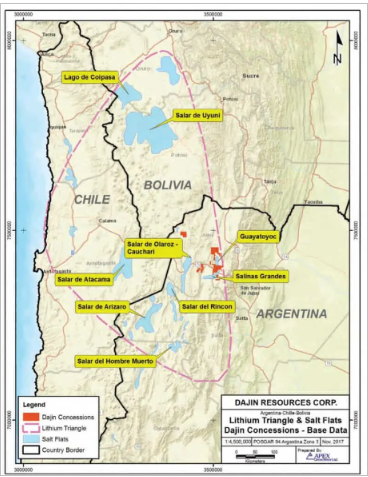

Chile, China make their moves

First, nationalisation of the lithium industry in Chile was announced by President Gabriel Boric. The government must be a partner for anyone who wishes to establish a lithium project.

The second, and perhaps more worrying, was a story that the Taliban had been given US$10 billion in infrastructure projects by an unidentified Chinese corporation in exchange for access to Afghanistan's lithium riches.

At least twenty Chinese businesses have inquired about exploring in Afghanistan, and five Chinese corporations are known to have representative offices in Kabul.

In the case of Chile, the government intends to create a national lithium firm that will be in charge of selecting business partners for initiatives.

The New York Stock Exchange-listed companies SQM and Albemarle are permitted to operate independently until their current licences expire in 2030 and 2043, respectively.

Future lithium licences, according to President Boric, will only be granted through public-private partnerships under governmental supervision.

Lithium cartel being explored in Latin America

Mexico made a similar move with regard to its own lithium resources last year.

However, it has since been claimed that Mexico has suggested forming a bloc with Chile, Argentina, Bolivia, and other countries to control more than 65% of the world's known lithium reserves.

As per the discussions among the suggested partners, the cartel would promote downstream processing and entry into the battery industry.

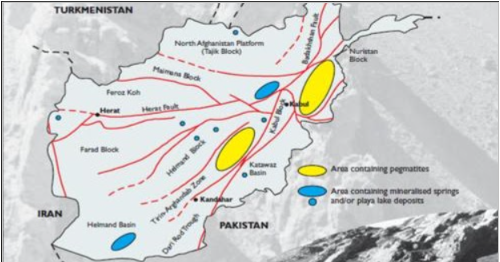

Taliban controls one of world’s largest lithium resources

The situation in Afghanistan is dire because, according to the Washington-based Brookings Institution, the nation is thought to hold the second-largest lithium reserve in the world (behind Bolivia), along with 2.3 billion tonnes of iron ore, 30 million tonnes of copper, and 1.4 million tonnes of rare earth elements.

China reportedly made their approach on the matter on April 13 at the office of Sheikh Hadith Shahabuddin Delawar, the acting minister of petroleum and mines for the Taliban.

Indeed, according to a news statement issued by that ministry, the country's lithium resources would be developed to the tune of one million jobs, including indirect jobs.

Thus, US President Joe Biden gave the Taliban military hardware worth billions of dollars by abruptly leaving Afghanistan, but he also gave the Chinese an opportunity.

Afghanistan’s ‘stunning potential’ as lithium producer

An internal paper that the US had been working on on Afghanistan's mineral riches was leaked from the Pentagon back in 2010.

The information was widely disseminated, albeit in relatively short form, but it received extensive coverage in the New York Times, which quoted General David Petraeus, the US Central Command chief at the time, as saying that the studies indicated "stunning potential" for mineral development.

According to the report, experts from the Pentagon believed that Afghanistan may emerge as the "Saudi Arabia of lithium" and become a significant global producer of copper and iron ore in the future.

Overall, the report stated at the time that the nation might develop into a "major mining centre of the world."

According to the US Geological Survey, known deposits in Afghanistan may contain iron ore worth US$421 billion, but the accuracy of such an estimate should not be taken too seriously. Several media reports have stated that the total value of the country's mineral endowment is estimated to be between US$1 trillion and US$3 trillion, which is a fairly elastic estimate.

Australia may not be able to offer the globe with as much rare earth elemental material as the USGS projected that the Helmand province alone may have up to 1.4 million tonnes of these elements. Beijing would be able to continue to keep its stranglehold on those essential crucial metals if it could maintain control over those resources and its downstream processing capabilities.

Along with striking quantities of cobalt, gold, molybdenum, rare earths (estimated at US$7.4 billion), silver, potash, bauxite, and graphite, Afghanistan also included a lot of niobium.

‘Rich salt lakes’ with lithium

According to the article, US surveys conducted in the western part of Afghanistan have discovered dry salt lakes with lithium concentrations so high they would be comparable to Bolivia's.

Even if the Chinese applied their can-do mentality to the assignment, it would be many years before any mines were created.

Additionally, China has already stated that it wants to support Afghanistan's "reconstruction and development."

Afghan minerals harnessed to Belt and Road

It is evident that Beijing intends to include Afghanistan in the Belt and Road Initiative (BRI). The fact that a pass on the 76 km-long border between the two nations was once a passage on the ancient Silk Road—the model for the modern BRI—is a telling feature. This time, instead of horses and camels, expect to see a roadway and rail line.

China might be able to establish Afghanistan as a vassal state, something that others have not been able to do. In that scenario, they will be in charge of Afghanistan's mineral resources.

The British Raj was unable to conquer the Afghans; during its ill-fated withdrawal from Kabul in 1842, 16,000 soldiers perished.

Then, in more recent times, the Soviet invasion backfired.