Knowing the ins and outs of the Canadian market is essential for prudent investing in an ever-changing global economic environment.

This book seeks to give a thorough summary of what to anticipate from the Canadian stock market in 2024, including information on important industries, economic indicators, and investment methods appropriate for this particular setting.

We'll look at how the Canadian investment environment is shaped by the interaction of national fiscal policies, international economic trends, and industry-specific factors.

We will also explore useful advice for managing the market, emphasising fundamentally-based long-term investing, and avoiding the traps of speculating.

Equities in Canada

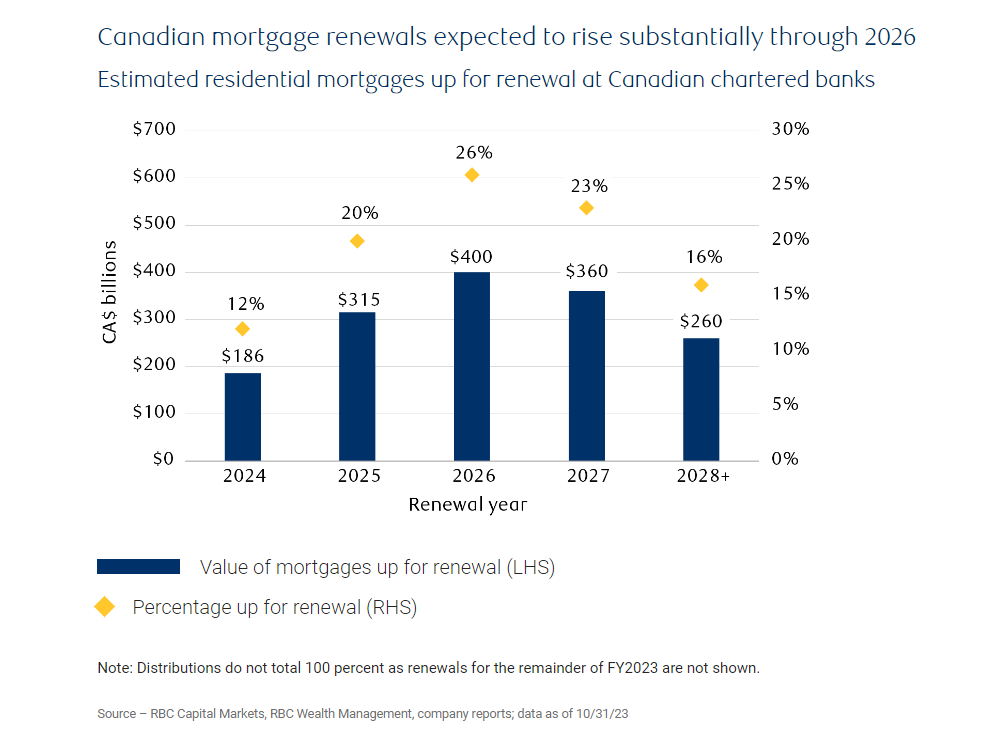

As restrictive monetary policy and its effects on consumer finances continue to permeate the Canadian economy, the focus should stay on the Canadian consumer in 2024. In comparison to its less developed southern neighbour, Canada's economy is weaker due to the unique dangers associated with high household debt levels and the housing sector's disproportionate influence on the economy. Higher interest rates are starting to bite into household budgets, as consumer spending is clearly declining. RBC Economics reports that compared to a year earlier, Canadians are spending almost 10% more on necessities. Concurrently, there has been a slowdown in the growth of discretionary expenditure and a decline in dining out and travel expenses.

The Canadian property market also seems to be slowing after a robust start to 2023, and the psychological effects of a declining net worth are placing additional strain on Canadian households.

The Economy and Interest Rates

In 2024, the Canadian economy is predicted to grow slowly, mostly due to internal variables like interest rate policies and external economic situations.

Potential loosening of restrictive measures by the Bank of Canada could lead to a change in the dynamics of the economy. All signs, however, point to cautious market conditions and limited growth that will persist.

Effects on the Financial Industry

Despite the difficulties presented by the current economic climate and inconsistent financial outcomes, Canadian banks—a substantial part of the TSX—have proven resilient.

The banks are trading at prices that reflect a cautious market outlook, with several selling below 10 times earnings and delivering appealing dividend yields. They have remained well-capitalized, and even if earnings expectations for 2024 are being reduced.

Investors face a mixed bag in this scenario, with potential for long-term profits, particularly if the economy is able to achieve a "soft landing" and interest rates are lowered, which would improve the outlook for the economy.

Trends Particular to a Sector

The Energy Industry

Commodity prices are expected to have a significant impact on the energy sector's performance.

With robust financial sheets and manageable capital expenditure requirements, Canadian energy businesses are well-positioned to handle any economic headwinds.

This industry may present appealing prospects for income-focused investors, particularly if the overall economic climate stays positive.

Bond and Fixed Income Markets

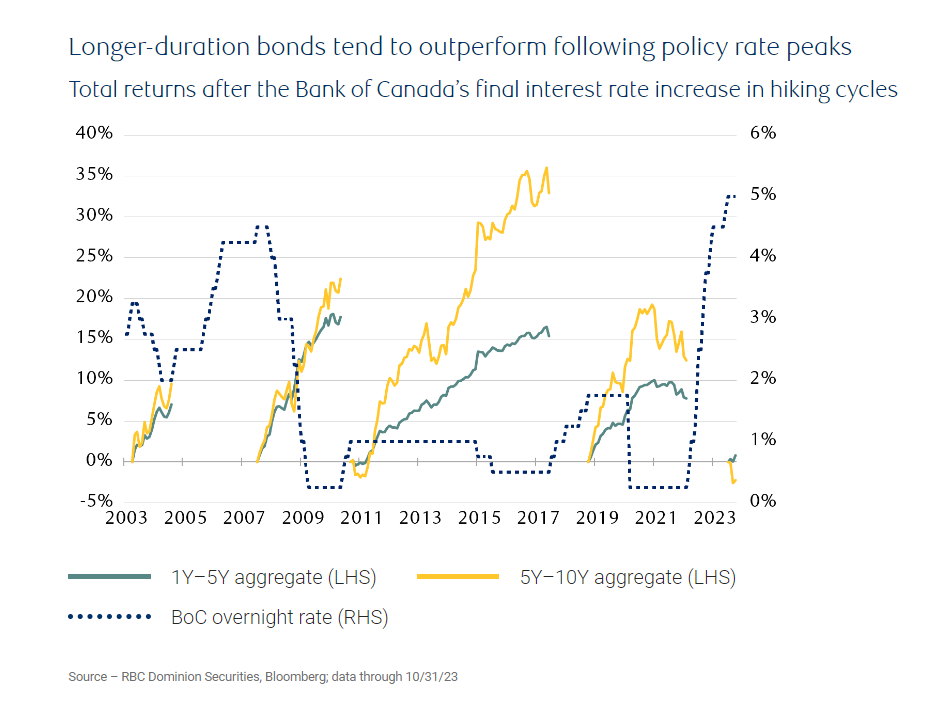

There are indications that the fixed-income market is changing, and there is less chance that interest rates will rise forever.

This change raises the possibility of longer durations in fixed-income strategies. Longer-duration bonds have historically performed better after policy rate rise peaks.

A more conservative approach, where investors progressively increase the duration in their portfolios while retaining some degree of diversification, may be something to think about.

It is acceptable to explore lengthening duration in portfolios after three years of sheltering in short-duration assets while the BoC carried out almost 500 basis points worth of interest rate rises. Nonetheless, we believe it is wise for investors to lean in cautiously and adjust their exposure to their rate volatility tolerances, even in spite of the more alluring risk-reward profile of duration at this moment. By extending maturities through laddering, this duration viewpoint can be reflected in portfolios while preserving a certain level of duration diversification. This exposes the portfolio to a higher level of rate sensitivity while reducing return volatility, which should result in a smoother return path.

2024 Investment Strategies

Diversification Is Essential

In a year when uncertainties and moderate growth are anticipated, diversity is still a crucial tactic.

To reduce risks connected with the Canadian market, investors should think about diversifying their holdings across a number of industries, even those that are exhibiting relative strength, such as energy. They should also think about exploring exposure to foreign markets.

Long-Term Emphasis on Fundamentals

It is more important than ever to emphasise fundamentally-based, long-term investing. One should concentrate on companies with robust balance sheets, sound management, and sound business models in a situation where market volatility might make speculation enticing.

Examining Stocks That Pay Dividends

Dividend-paying equities, particularly those with a track record of steady and increasing dividends, may be a prudent investment given the prospects for slow growth and prospective interest rate reductions.

They have the potential to increase in value over time and offer a reliable source of income.

Risk Assessment

Being Wary of Using Leverage

Using leverage in a market that is prone to volatility calls for caution. Both gains and losses can be amplified by leverage, particularly in a volatile market.

Continual Evaluations of Portfolios

Reviewing your financial portfolio on a regular basis is crucial. This approach enables you to modify your assets in response to shifting market conditions and individual financial objectives.

Remaining Acquired

Staying updated about economic trends, both nationally and internationally, can assist you in making better-informed investing choices. Gaining knowledge about the market's driving forces might help you identify opportunities and possible threats.

Steer clear of panic selling

Avoiding panic selling is crucial when the market is volatile. Emotional responses to transient market fluctuations might undermine long-term financial objectives.

In 2024, investing in Canadian stocks calls for a well-rounded strategy that prioritises basic analysis, diversification, and a long-term outlook.

The market may present a number of obstacles, but there are also chances for those who are equipped to meet these head-on.

As always, while making selections, investors should take into account their unique risk tolerance and investment objectives. Consulting with financial experts can also be helpful in developing an appropriate investment plan for the upcoming year.