Canada, home to almost 38 million people, is the eighth-largest pharmaceutical market globally. It also boasts one of the most inventive pharmaceutical sectors in the nation. The industry is made up of companies that create and produce over-the-counter medications, novel medications, and generic pharmaceuticals.

Pharmaceutical Companies in Canada are covered by the report, and the market is divided into ATC/Therapeutic Classes (Blood and Blood-Forming Organs, Cardiovascular System, Dermatologicals, Genito Urinary System and Sex Hormones, Systemic Hormonal Preparations, Antiinfectives for Systemic Use, Antineoplastic and Immunomodulating Agents, Musculoskeletal System, Nervous System, Insecticides and Repellents, Respiratory System, Sensory Organs, and Various Other ATC/Therapeutic Classes) and Drug Type (Prescription Type (Branded and Generic) and OTC Drugs”). The Value (in USD Million) for the Aforementioned Segments is provided in the report.

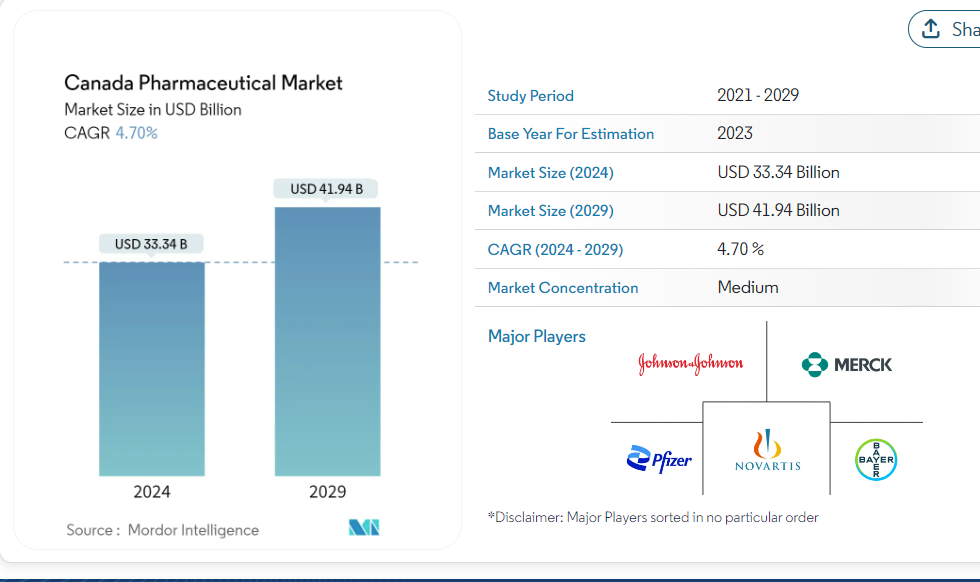

Size of the Canadian Pharmaceutical Market

There are multiple subsectors within the Canadian pharmaceutical industry that cater to distinct market niches. Medications sold under brand names and generics, small and medium-sized businesses (SMEs), contract manufacturing organisations (CMOs), and contract research organisations (CROs) are a few of them.

Pharmaceutical firms do research and development to create novel treatments or enhance already-patented ones. After the patents on medications expire, other businesses try to create bioequivalent versions of the medications. Nanomedicines and gene and cell therapies are emerging areas in the industry.

Canada is the eighth-largest pharmaceutical market in the world, with sales accounting for 2.2% of the global pharmaceutical industry. Since 2017, the cumulative annual growth rate (CAGR) has stayed at 6.4%.

It was projected that the pharmaceutical market in Canada would reach $65.9 billion in 2023. It is anticipated that the market will expand at a little quicker pace of 6.88% CAGR. Numerous variables, such as Canada's ageing population, rising healthcare costs, the need for novel treatments, and a strong emphasis on research and development, are contributing to the quicker increase.

In Canada, 80.5% of sales value is made up of name-brand goods. In terms of quantity, they likewise account for 25.7% of all prescriptions. 74.3% of prescriptions are generic, accounting for 19.5% of the market sales value.

The size of the Canadian pharmaceutical market is projected to be USD 33.34 billion in 2024 and is projected to expand at a compound annual growth rate (CAGR) of 4.70% to reach USD 41.94 billion by 2029.

As a result, the market is anticipated to increase throughout the forecast period due to the growing geriatric population, the rising prevalence of diabetes and cancer, and these factors. Over the course of the projection period, however, it is anticipated that the high costs of several pharmaceutical medications would impede the expansion of the pharmaceutical market in Canada.

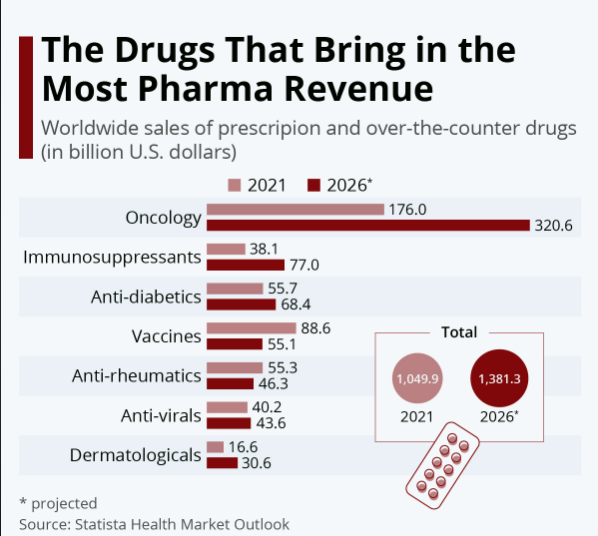

Canada's Drug Sales

Between 2012 and 2021, the entire value of pharmaceutical sales in Canada—which includes over-the-counter and non-patented medications—rose by 56.4% to $34.1 billion. The total sales of patented and non-patented medications in 2021 was $17.4 billion and $16.7 billion, respectively. Statista projects that by 2024, Canada's overall pharma expenditure will come to $47.9 billion.

The sale of medications is handled by a number of methods in Canada. In Canada, consolidated distributors account for 56.8% of drug sales, self-distributing pharmacy chains account for 35.5%, and pharmacies directly purchase 7.7% of all drug sales.

Leaders in the Canadian Pharmaceutical Market

Activities related to Research and Development

Eighty-two percent of innovator biologics and sixty percent of innovator small molecules have their origins outside of major pharmaceutical corporations throughout the past ten years. As a result, more research and development is carried out by Canadian CROs.

Over the past 12–13 years, the average research and development expenditure per medicine has been $1.8 billion. Generic medications typically take two to three years to produce and need to be funded between $3 and $10 million in order to demonstrate their equivalentity to the brand-name medication.

Canadian Pharmacies and Pharmacists

In Canada at the beginning of 2024, there were 50,069 registered or licenced chemists, according to the National Association of Pharmacy Regulatory Authorities (NAPRA). Thirty percent of chemists work in hospitals and other settings, with the remaining seventy percent primarily employed in community pharmacies. The pharmaceutical sector, associations, governments, colleges, and universities are among the various environments.

Canada boasts one of the largest global pharmaceutical marketplaces. Additionally, Canada boasts a robust pharmaceutical sector that employs workers in a number of ancillary fields, such as production, sales & marketing, research & development, and pharmacies.

Large international businesses dominate the Canadian pharmaceutical market, with the top ten products accounting for over half of total sales. The pharmaceutical sector is expected to continue expanding in the future due to the ageing population's increased need for medications.