The Australian education sector is framed to provide study from an early stage to higher education for both domestic and international students.

School Education: Primary and Secondary

Australia’s school education system spans 13 years, beginning with Kindergarten or Prep (ages 5–6) and continuing through Year 12 (ages 17–18). The curriculum covers subjects such as English, mathematics, science, humanities, the arts, and physical education, while also promoting communication and teamwork skills. Schools include government, non-government, faith-based, and those following specific educational philosophies like Montessori and Steiner. Students receive a Senior Secondary Certificate of Education at the end of Year 12, which varies by state (e.g., HSC in NSW, VCE in Victoria).

Higher Education

Higher education in Australia is offered by universities and non-university providers, including TAFEs and private institutions. Programs range from associate and bachelor’s degrees to postgraduate and doctoral qualifications. Most undergraduate degrees take three years, with postgraduate studies lasting one to two years and doctoral programs typically requiring around three years. Academic intakes mainly occur in March, with many institutions also offering mid-year entry options.

|

As per EMR and IMARC, the Australian education sector is estimated at AUD 256.83 billion in 2024, with a robust compound annual growth rate (CAGR) of 8.9%. The higher education segment contributes AUD 57.10 billion to this figure. Forecasts indicate the total market will grow to AUD 279.69 billion in 2025 and reach AUD 602.45 billion by 2034, reflecting strong long-term growth potential. |

Key Statistics (2019–2024):

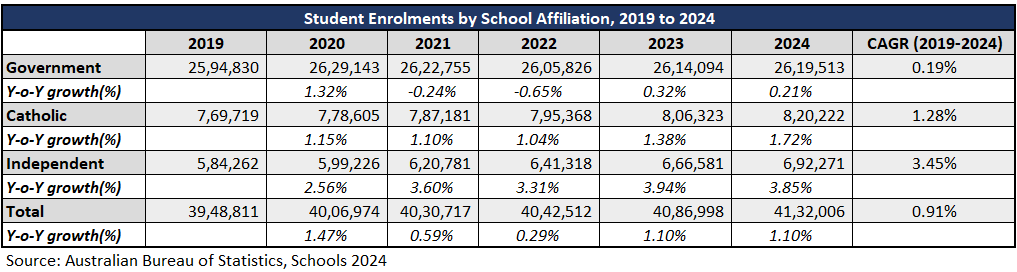

Student Enrolments by School Affiliation, 2019 to 2024:

- In 2024, 41,32,006 students enrolled in schools in Australia.

- Government schools account for the largest share of student enrolments at 63.40%, followed by Catholic schools with 19.85%, and independent schools with 16.75%.

- The full-time apparent retention percentage from years 7/8 to 12 was 79.9%.

- The average student-to-teacher ratio across all schools was 12.9:1.

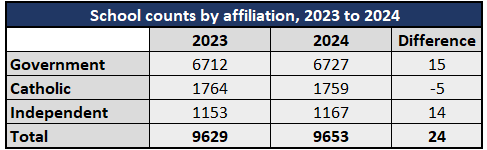

- School Count by Affiliation (2023 to 2024):

Source: Australian Bureau of Statistics

- The number of schools rose by 24 in 2024, indicating steady investment and growth potential in the education sector.

- The decrease of five Catholic schools may be attributed to institutional consolidations, school closures, or changes in enrolment trends affecting the sector.

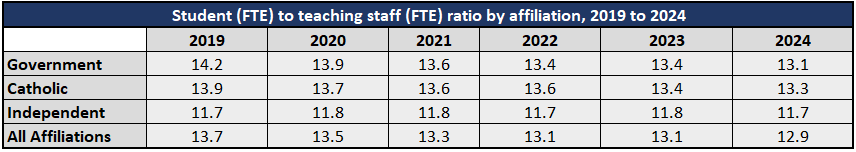

- Student-to-teaching staff ratio

Source: Australian Bureau of Statistics

- Between 2019 and 2024, student-to-teaching staff ratios declined across all school sectors, with government and Catholic schools exhibiting significant improvements. This trend reflects ongoing investment in educational staffing and resources, contributing to improved teaching quality and student outcomes.

- Independent schools consistently maintained a student-to-teacher ratio of approximately 11.7 between 2019 and 2024, indicating stable staffing levels relative to student enrolment throughout this period.

Growth Drivers: Here are a few growth drivers for the education sector in Australia, noted below:

- Government Support: The Higher Education Loan Program (HELP) by the Department of Education supports growth in Australia’s education sector by improving access to tertiary study. Removing upfront financial barriers enables more students to pursue higher education, leading to a more skilled workforce. Income-based repayments and multiple loan options—like HECS-HELP and FEE-HELP—make it easier for diverse student populations to enrol, promoting educational participation and long-term sector growth.

- Population Growth: Population growth is another element fuelling the growth of Australia’s education sector. According to ABS data, the population grew by 1.8% (484,000 people) in the year to September 2024, with net overseas migration contributing 379,800 people. This increase leads to higher enrolments across early childhood, school, and tertiary education, creating greater demand for facilities, educators, and investment in the sector's infrastructure and services.

- Tech-Driven Education: Technology plays a major role in the growth of Australia’s education sector, backed by government efforts such as the Australian Framework for Generative AI in Schools. Introduced in 2023, this framework encourages the safe and responsible use of AI to support teaching and learning. By integrating digital tools into classrooms, it helps improve educational access, personalisation, and efficiency, contributing to a more modern and adaptable education system.

- Cross-Border Collaboration: A key factor driving growth in Australia’s education sector is international collaboration, such as the Australia-Vietnam EdTech Innovation Exchange. These partnerships enable Australian education technology firms to enter expanding markets in Southeast Asia. Supported by government and educational institutions, they exchange knowledge, enhance their products, and increase exports. This global reach attracts more investment by demonstrating strong business potential, contributing to the overall expansion of the education industry.

- School-Family Relationships: Fostering meaningful engagement between schools and families significantly contributes to student success. Active involvement from parents, carers, and community members helps create a positive school culture, encourages student participation, and promotes wellbeing. These partnerships build trust and shared accountability, ultimately enhancing the learning environment and supporting students' social and academic development.

- Increasing demand for Pre-schooling: Preschool in Australia helps children build important skills before they begin school. These play-based programs, run by trained teachers, support children's learning, confidence, and social development. They follow national guidelines to make sure quality is high. With help from the government, more children can attend preschool, making it easier for them to succeed in school and helping the education system grow.

Challenges: Let’s have a look on few challenges related to the Australian education sector.

- Regulatory and Policy Uncertainty: Changes in immigration, fee structures, or funding policies can impact revenues, especially for higher education and international student services.

- Economic Sensitivity: Recessionary pressures or cost-of-living issues may reduce discretionary spending on private education or premium learning services.

- Unequal School Funding: Public schools get less money than private schools, which means they often have fewer resources and opportunities for students. This funding gap makes it harder for public schools to provide the same quality of education, especially for students from less advantaged backgrounds. Fixing this issue is important to make sure all students have a fair chance to succeed.

- Teacher Shortages and Workload: Many schools face a shortage of teachers, which leads to bigger class sizes and more pressure on existing staff. Teachers often have heavy workloads and don’t always get enough training or support. This makes it harder for them to do their best and can affect the quality of education students receive. Supporting teachers better is key to improving schools.

Key Stocks to Watch

IDP Education Limited (ASX: IEL): IDP Education Limited (ASX: IEL) is a recognized provider of international education services, providing its services in 57 countries, headquartered in Melbourne, Australia. It supports students through every stage of their study journey—from initial research to enrolment—using a blend of expert advice and a leading digital platform. IDP also delivers English language testing and education through IELTS and its schools.

From a financial standpoint, the revenues of IEL for the year 2024 stood at AUD 1.037 billion, increased from the last year’s revenue that was AUD 0.981 billion, which shows a year-on-year growth of 5.71%. Earnings-per-Share of IEL represents a value of AUD 0.47. Price-to-Earnings ratio of IEL stood at 7.67x, and price-to-free cash flow ratio stands at 6.52x.

Stock Performance

Weekly Chart (Source: Investing.com)

Over the last month, the share of IEL has shown a downward trend. Over the last one year, the lowest value of the share was AUD 3.405 and the highest price was AUD 17.10. The stock is currently trading at AUD 3.67 with a market capitalization of AUD 993.66 billion and annual dividend yield of ~5.04%.

G8 Education Limited (ASX: GEM): G8 Education Limited (ASX: GEM) is an early childhood education provider in Australia, operating a network of over 400 centres under various well-known brands. The company focuses on supporting children's early development through learning environments and research-based teaching approaches. With a strong emphasis on recognising each child's unique abilities, G8 Education aims to foster lifelong learning and positive outcomes.

From a financial standpoint, the revenues of GEM for the year 2024 stood at AUD 1.015 billion, increased from the last year’s revenue that was AUD 0.983 billion, which shows a year-on-year growth of ~3.26%. Earnings-per-Share of GEM represents a value of AUD 0.083. Price-to-Earnings ratio of GEM stood at 14.00x, and price-to-free cash flow ratio stands at 5.24x.

Stock Performance

Weekly Chart (Source: Investing.com)

Over the last month, the share of GEM has shown a downward trend. Over the last year, the lowest value of the share was AUD 1.145 and the highest price was AUD 1.435. The stock is currently trading at AUD 1.175 with a market capitalization of AUD 902.72 million and annual dividend yield of ~4.70%.

3P Learning Limited (ASX: 3PL): 3P Learning Limited (ASX: 3PL) is an education technology company that delivers interactive digital learning solutions used in classrooms and homes worldwide. With programs like Mathletics, Reading Eggs, and Mathseeds, it aims to make learning enjoyable and meaningful for students. The company values innovation, collaboration, and authenticity, and supports a global community of learners and educators. Its approach combines educational expertise with digital innovation to help learners thrive.

From a financial standpoint, the revenues of 3PL for the year 2024 stood at ~AUD 109.94 million, increased from the last year’s revenue that was AUD 106.9 million, which shows a year-on-year growth of 2.84%. Earnings-per-Share of 3PL represents a value of AUD -0.207.

Stock Performance

Weekly Chart (Source: Investing.com)

Over the last year, the lowest value of the share was AUD 0.590 and the highest price was AUD 1.225. The stock is currently trading at AUD 0.660 with a market capitalization of AUD 180.11 million.

OpenLearning Limited (ASX: OLL): OpenLearning Limited (ASX: OLL) is an education technology company offering an AI-enhanced platform for online learning. It supports over 250 education providers and 3.5 million learners globally. The platform enables the delivery of micro-credentials, short courses, and degrees, focusing on interactive and student-driven learning. OpenLearning has a strong presence in Australia and Southeast Asia.

From a financial standpoint, the revenues of OLL for the year 2024 stood at AUD 2.283 million, decreased from the last year’s revenue that was AUD 2.293 million, which shows a decline of -0.44%. Earnings-per-Share of OLL represents a value of AUD -0.007.

Stock Performance

Weekly Chart (Source: Investing.com)

Over the last month, the share of OLL has shown a declining trend. The stock is currently trading at AUD 0.014 and has a market capitalization of AUD 6.75 million. Over the last year, the lowest value of the share was AUD 0.011, and the highest price was AUD 0.028.

Embark Education Limited (ASX: EVO): Embark Education Limited (ASX: EVO) is a leading early childhood education organisation in Australia, managing a network of centres that operate independently to serve their local communities. Supported by a central team, these centres focus on delivering quality care and education. The company is dedicated to creating nurturing environments where experienced educators help children grow and reach their potential.

From a financial standpoint, the revenues of EVO for the year 2024 stood at AUD 81.611 million, increased from the last year’s revenue that was AUD 63.123 million, which shows a growth of ~29.29%. Earnings-per-Share of EVO represents a value of AUD 0.049. At the current price, price-to-earnings ratio of EVO stood at 12.62x with price-to-free cash flow ratio of 10.25x.

Stock Performance

Weekly Chart (Source: Investing.com)

Over the last month, the share of EVO has shown a declining trend. Over the last year, the lowest value of the share was AUD 0.665, and the highest price was AUD 0.820. The stock is currently trading at AUD 0.700 with the market capitalization of AUD 131.18 million and annual dividend yield of ~8.39%.

Conclusion

In 2024, the Australian education sector is valued at approximately AUD 256.83 billion, fueled by government initiatives, population growth, and the integration of advanced technologies like AI in classrooms. Serving over 4.1 million students across early childhood, school, and higher education levels, the sector faces challenges such as funding disparities and teacher shortages. However, growth is supported by international collaborations and strong engagement between schools and families. Investment prospects are notable in companies like IDP Education, G8 Education, 3P Learning, alongside tech-driven firms like OpenLearning and the expanding early childhood provider Embark Education. Overall, the sector shows strong long-term growth potential driven by demographic shifts and technological advancements.