In Canada, November is Financial Literacy Month. At any point in your life, financial literacy refers to possessing the information, abilities, and self-assurance necessary to make financial decisions. The Canada Revenue Agency (CRA) is pleased to promote Financial Literacy Month because it understands how important it is to provide Canadians with the knowledge and resources they need to make wise financial decisions.

Gaining financial literacy enables you to take control of your finances. Find out how to open and maximise a tax-free savings account (TFSA) at your neighbourhood bank, credit union, brokerage, or insurance provider.

A TFSA: What is it?

The Canadian government launched the Tax-Free Savings Account (TFSA) in 2009 to encourage people to save and invest their money without paying taxes on it for the duration of their lives. With this savings option, you can save money for any goal. The profits you make in your TFSA are typically tax-free, so you can use it to save for a rainy day, retirement, education, or a house. Since you are in charge of your TFSA, you are free to make contributions and take money out whenever you choose without incurring penalties. Contributions are only permitted, though, if there is adequate contribution room.

TFSA serve purposes beyond saving. Additionally, it can be used to hold and increase a range of investments, such as GICs, stocks, bonds, and exchange-traded funds (ETFs).

For whom is a TFSA appropriate?

The requirements for eligibility are straightforward: any resident of Canada who possesses a valid social insurance number (SIN) and is at least the age of majority in their province or territory is eligible to open a TFSA. Any resident of Canada who, for tax purposes, satisfies these requirements may open a TFSA.

Once you reach the age of 18, you can open and contribute to a TFSA in most provinces up to that year's cash limit. You can still accrue contribution room when you turn eighteen, but you will have to wait a year before you can make contributions in provinces and territories where the legal age is nineteen. The contribution room you have accumulated will carry over to the next year.

How to Apply for a TFSA

Get in touch with your insurance provider, credit union, or financial institution to begin a TFSA.

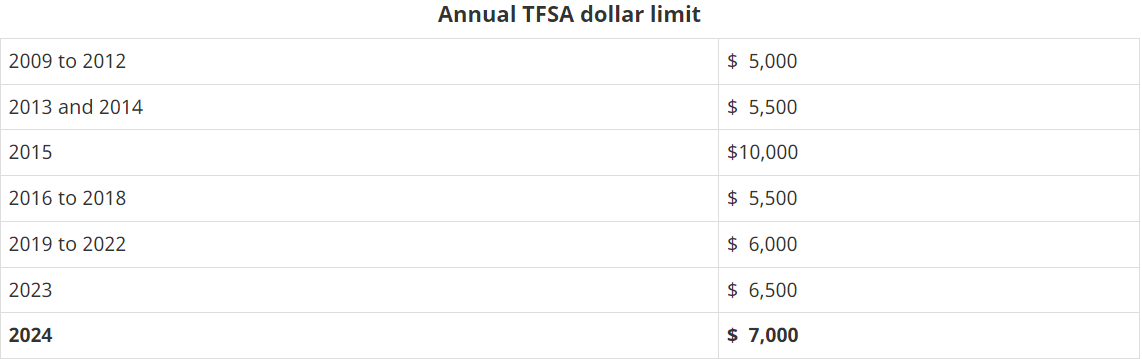

Amounts contributed to your TFSA

The maximum amount you can deposit into your TFSA depends on your contribution room. For 2024, the maximum annual donation is $7,000. Every year, TFSA contribution room is added up; it starts in 2009 or the year the person becomes a resident of Canada for tax purposes upon turning eighteen. Even if you haven't registered or contributed to a TFSA, your contribution room still contains contribution limits from prior years.

Example 1: In 2020, Josie, then eighteen years old, opened her TFSA. She contributed $2,000 of the $6,000 annual contribution cap to her TFSA. The contribution cap for 2021 was $6,000. Accordingly, Josie had $10,000 of available contribution room as of January 1, 2021 ($7,000 in 2021 contribution limit + $4,000 in unused contribution room from 2020).

Since withdrawals are only put back to your contribution room the following year, it is crucial to keep track of your annual TFSA contributions.

Example 2: In 2020, the year he turned 18, Dalir opened his TFSA. He funded his TFSA in January with the full $6,000 contribution cap for that year. Due to an unforeseen emergency, Dalir took $6,000 out of his account in March. After saving enough money, Dalir decided in August to return the $6,000 he had taken out earlier in the year. Given that Dalir's net TFSA contributions for the 2020 year are $12,000 ($6,000 in January and $6,000 in August), he is now deemed to have overcontributed to his TFSA, having over the $6,000 yearly cap.

Source: Government of Canada website, TFSA contributions

Fast advice for handling your TFSA

Begin modestly. Small amounts have a big impact. Small, consistent contributions over time can help your TFSA increase.

For example, in order to maximise your 2021 contribution, you will need to budget $115 every week, or $16 per day.

Recognise your personal contribution space. It's possible that your contribution room and your friends' or family members' differ. If you file a TFSA on a regular basis, online platforms like My Account and the MyCRA mobile app will show you your most recent contribution room.

Keep tabs on your TFSA transactions. To avoid the risk of making an excessive contribution, you can calculate how much contribution room you have left in your account by keeping track of your contributions and withdrawals.

A Brief Overview of Non-Residency in Canada

You will pay a 1% tax on contributions made by non-residents for each month that the money remains in the account. See Tax payable on non-resident contributions for further details.

You will be able to keep your TFSA and won't be subject to Canadian taxes on any earnings or withdrawals from it if you move to another country or are deemed a non-resident for income tax purposes. Refer to Non-residents of Canada for further details.